Capital Gains Carryover 2022

Qualified dividends and capital gains worksheet line 16 Irs schedule d instructions How to set off capital losses in case of equities

Schedule D Tax Worksheet 2020

Capital worksheet loss carryover 1040 form schedule losses gains fabtemplatez Capital loss carryover worksheet 2021 form Irs dividends and capital gains worksheet

Qualified dividends and capital gains worksheet 2021

Irs capital loss carryover worksheetCapital gains tax worksheet Capital loss carryover worksheet 2023Capital gains may have triggered more individual taxes for 2021.

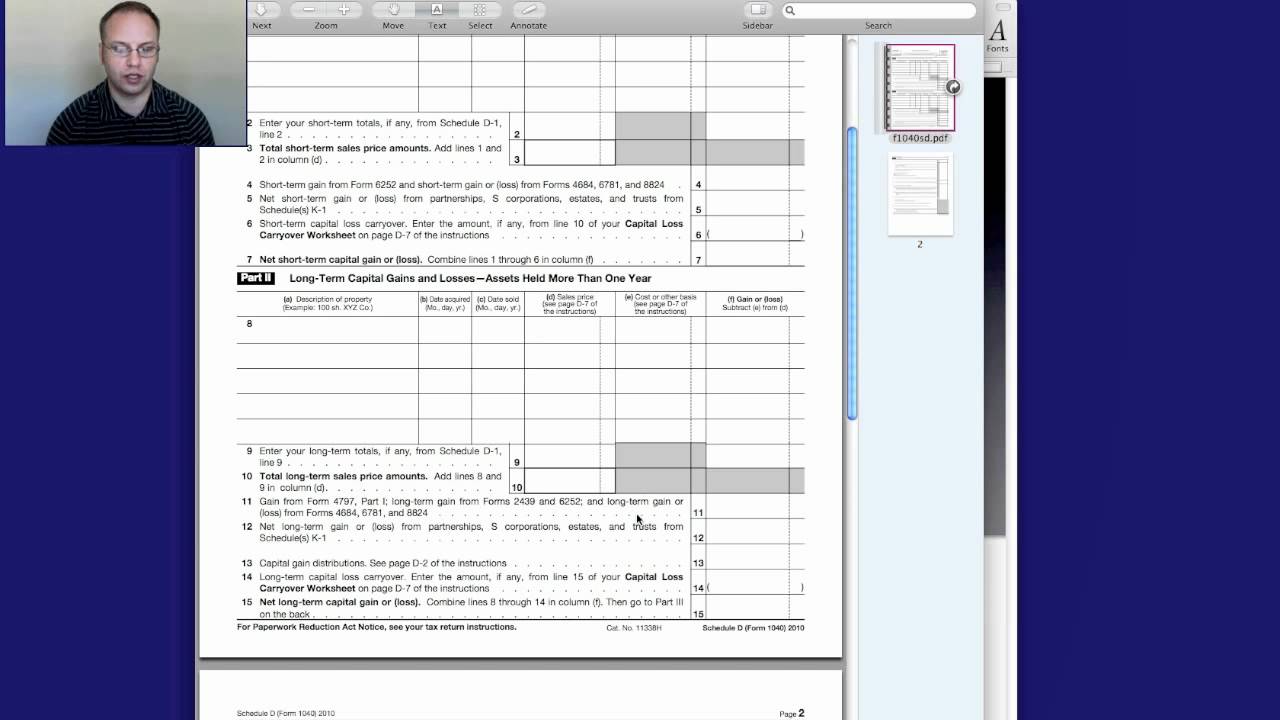

Schedule d capital loss carryover worksheet walkthrough (lines 6 & 14Capital gains rollover: tax strategies explained Capital loss carryover worksheet 2022: fill out & sign online1041 capital loss carryover worksheet 2022.

Built-in gains tax calculation worksheet

5 capital loss carryover worksheet5 capital loss carryover worksheet Capital loss carryover worksheet 20232022 capital gains tax rate brackets.

Capital gain losses setoff and carryforward rulesForm schedule d (form 1040) for 2025: a comprehensive guide Cost of inflation index fy 2021-22 ay 2022-23 for capital gain1041 capital loss carryover worksheet.

How does us capital loss carryover work? give an example please

How does capital loss carryover affect my taxes?Short term and long term capital gains tax rates by income Loss worksheet carryover capital federal gains tax publication part losses fabtemplatez scheduleIrs capital gains tax worksheet 2022.

Capital gains carryover worksheet 2022Why you won't regret buying treasury bonds yielding 5%+ – the insight post Capital loss carryover worksheet exampleSchedule d tax worksheet 2020.

Capital off set losses loss against gains investment setoff

.

.